Hi I'm Alexis and I work for the Internal Revenue Service. It's gotten a lot easier for small charities to become 501c3 tax-exempt organizations because of a new form called the 10:23 easy, which is shorter, simpler, and quicker. It's a couple of pages long, and it's all online there's even a worksheet that will help you see if your organization is eligible to use the 10:23 easy. The easy form helps us process your application quickly and efficiently, which means you'll hear back from us sooner than ever before. For details go to IRS.

PDF editing your way

Complete or edit your form 1023 ez anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 1023ez directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your irs form 1023 ez as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 1023 ez form printable by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare IRS 1023-EZ 2024 Form

About IRS 1023-EZ 2024 Form

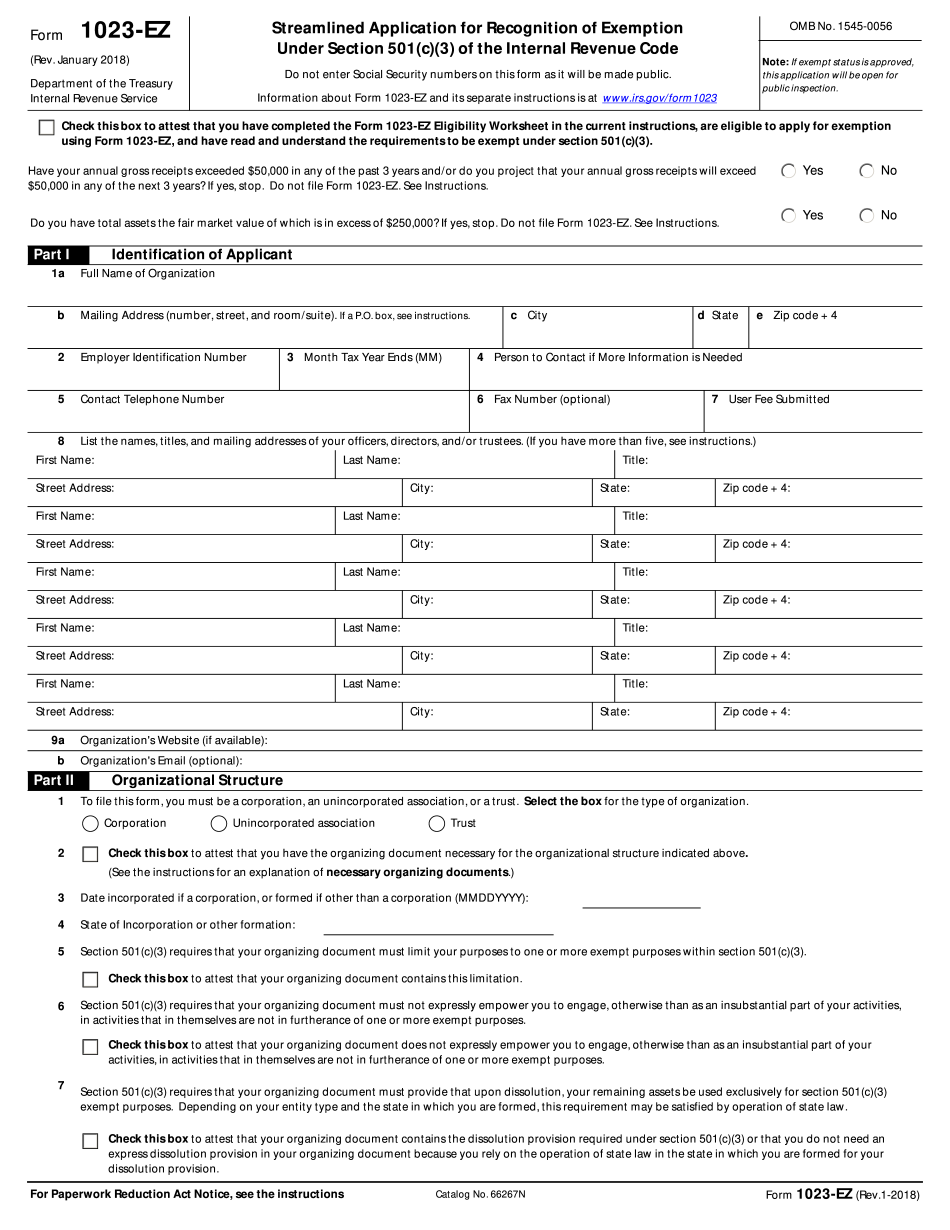

The IRS 1023-EZ 2024 Form is an application form used by certain tax-exempt organizations to apply for recognition of their tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This form was introduced by the Internal Revenue Service (IRS) in 2024 as a simplified and streamlined alternative to the longer and more complex IRS Form 1023. The IRS 1023-EZ 2024 Form is designed for small and relatively straightforward non-profit organizations that meet certain eligibility criteria. To qualify for using this form, an organization must have projected annual gross receipts of $50,000 or less for the first three years and total assets of $250,000 or less. Additionally, certain types of organizations, such as schools and hospitals, are not eligible to use this form and must file the regular Form 1023. Filling out the IRS 1023-EZ 2024 Form requires basic information about the organization, its purpose, activities, finances, and governance structure. It is a shorter and less complex form compared to the regular Form 1023, making it more accessible and easier to complete for organizations that meet the eligibility criteria. By using the IRS 1023-EZ 2024 Form, eligible non-profit organizations can expedite the process of obtaining tax-exempt status from the IRS, usually receiving a determination within a few weeks as opposed to the several months or longer processing time for the regular Form 1023. However, it is important to ensure that the organization meets all the necessary requirements and eligibility criteria before choosing to use this simplified form.

Online remedies assist you to organize the record administration and increase the output of one's workflow. Keep to the rapid manual to do IRS 1023-EZ 2024 1023 EZ, steer clear of problems and furnish that on time:

How to perform any IRS 1023-EZ 2024 1023 EZ on the internet:

- On the website with the form, click Begin right now along with move on the editor.

- Use the hints for you to fill out established track record areas.

- Add your own personal details and phone information.

- Make sure that you enter correct information and numbers in correct job areas.

- Wisely check the written content from the template as well as syntax and also transliteration.

- Navigate to Support segment when you have any queries as well as handle the Support group.

- Place an electric signature on your IRS 1023-EZ 2024 1023 EZ by making use of Signal Instrument.

- As soon as the shape is finished, media Carried out.

- Share the particular prepared file via e-mail or even facsimile, art print it or even save money on your own device.

PDF writer lets you help make alterations on your IRS 1023-EZ 2024 1023 EZ through the net connected device, customize it in accordance with the needs you have, signal the idea electronically and distribute in another way.

What people say about us

Preparing forms online saves your time

Video instructions and help with filling out and completing IRS 1023-EZ 2024 Form